Carvana Stock Is Causing Pain, With Hedge Funds Set to Feel the Worst

[ad_1]

(Bloomberg) — The spectacular plunge of Carvana Co.’s stock price is bringing pain to many investors, but one elite group on Wall Street is feeling it acutely — hedge funds.

Most Read from Bloomberg

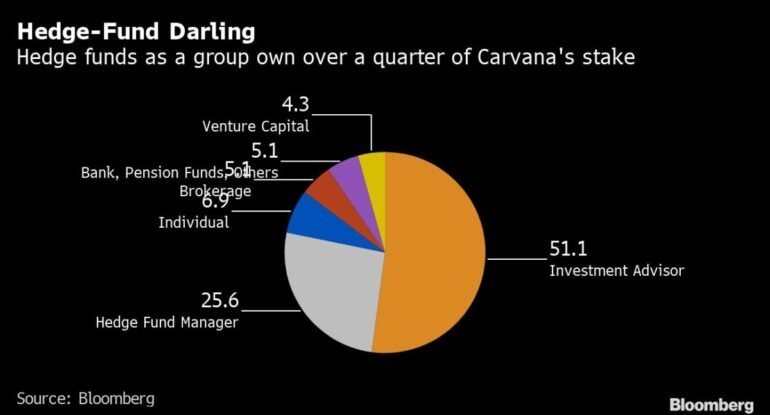

The online used-car dealer, which has seen its shares fall 97% in the last 12 months, was considered a hedge-fund darling, and for good reason. Collectively, these actively managed funds still own more than a quarter of the company’s shares, according to Bloomberg data.

Carvana’s tumbling fortunes represent just one among many growth investments that have gone awry for hedge funds this year, providing investors a rare glimpse into how the closely held firms have fared during the intense market selloff. Still, the sheer magnitude of Carvana’s rout stands out, threatening to put a sizable dent in their portfolio valuations.

“The company was burning cash flow at an alarming rate even before used car prices started declining,” said Ivana Delevska, chief investment officer at SPEAR Invest. “Now with their underlying market deteriorating, Carvana is facing liquidity issues and will requires significant balance sheet restructuring.”

Some have already opted to cut their losses and exit. Earlier this year, Tiger Global Management and D1 Capital Partners bailed on the company. Since D1’s disclosed exit in May the stock has sunk about 80%.

Carvana shares closed down 1.9% at $7.97 in New York on Friday. Its all-time closing high touched in August last year was $370.10.

About 15 months back, Carvana’s downfall was tough to predict. The company, whose technology allows people to buy their used cars from the comfort of their couch, was a pandemic winner. Investors flush with cash rushed into stocks and ideas that made it easier to conduct business without ever stepping outside the home.

But the tables turned this year, with liquidity getting tighter, inflation soaring and the Federal Reserve aggressively raising interest rates, the shares of unprofitable businesses have taken the biggest hits. Investors are now looking for stability and value in the face of a looming recession and have been quick to shun growth stocks. For Carvana, the realities of its business have also changed drastically.

During the pandemic prices of used cars rose to stratospheric heights as new-vehicle production stalled due to supply issues. This year, prices started ratcheting down rapidly as shortages eased, putting pressure on Carvana’s margins. At the same time, demand has cooled with consumers getting squeezed by high inflation and rising rates.

Earlier this month Carvana reported third-quarter results that fell short of analysts’ expectations. Chief Executive Officer Ernie Garcia said that “cars are extremely expensive, and they’re extremely sensitive to interest rates.”

Wall Street analysts, who have also started to sound the alarm, are seeing little hope for a quick turnaround.

JPMorgan analyst Rajat Gupta said there’s no reason to buy neutral-rated Caravana shares currently. “Even when the industry bottoms out, we don’t see a V-shaped recovery in the industry, particularly given challenging supply dynamics in the medium term for one to five-year old cars and negative equity risk, along with Carvana’s increasing debt burden,” he wrote in a note dated Nov. 22.

Spruce House Investment Management LLC, FPR Partners LLC, 683 Capital Management LLC, Point72 Asset Management LP and KPS Global Asset Management UK Ltd are the hedge funds with the largest positions in the company as of Sept. 30, according to data compiled by Bloomberg.

(Updates stock move in sixth paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Source link